- +91 937 3911 933

- vptaxproservices@gmail.com

- Bhujbal chowk, Wakad, Pune, Maharashtra 411057

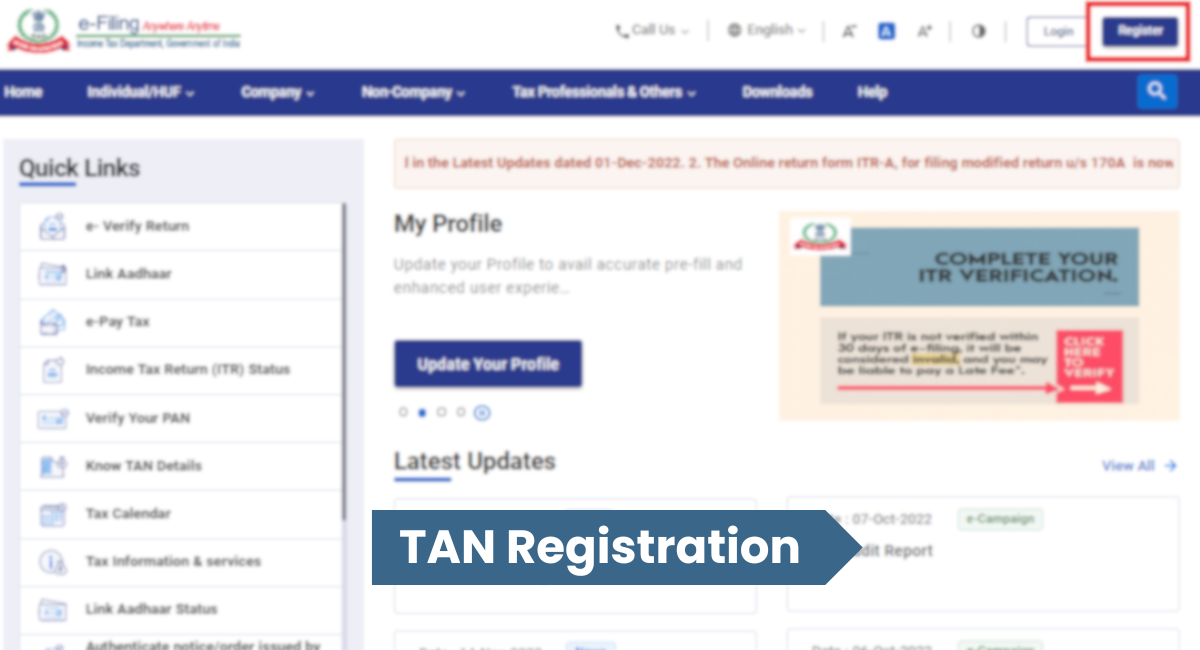

TAN Registration is a statutory requirement imposed by the Income Tax Department for entities liable to deduct tax at the source (TDS) or collect tax at source (TCS) on various transactions. Entities engaged in specified transactions, such as salary payments, contractor payments, and interest payments, are legally obligated to possess a valid TAN for compliance with tax deduction provisions.

TAN facilitates the deduction of taxes at the source from various payments made by businesses, such as salaries, contractor fees, and interest payments, ensuring compliance with tax deduction provisions under the Income Tax Act. For entities required to collect tax at source (TCS) on specific transactions, such as sale of goods, TAN enables the collection of taxes and subsequent remittance to the government, ensuring adherence to tax collection provisions.

TAN Registration enables businesses to conduct financial transactions smoothly by ensuring compliance with tax deduction and collection requirements. Non-compliance with TAN Registration can lead to penalties and legal consequences, hindering business operations and financial transactions.

TAN serves as an official identification number for entities required to deduct or collect taxes at the source, providing a unique identifier recognized by tax authorities for tax-related transactions. TAN Registration provides a means for tax authorities to verify the legitimacy of tax deductions or collections made by entities, ensuring transparency and accountability in tax-related activities.

We begin by conducting an initial consultation with the client to understand their specific TAN Registration requirements and gather necessary information. Our experts address any queries or concerns raised by the client regarding TAN Registration, providing clear explanations and guidance.

We assist the client in gathering and organizing the required documentation for TAN Registration, including identity proof, address proof, PAN details, and business-related documents. Our team verifies the authenticity and completeness of the submitted documents to ensure compliance with regulatory requirements.

We help the client complete the TAN Registration application form accurately, providing guidance on filling in the required details and information. Our experts compile all necessary documents and information to be submitted along with the TAN Registration application, ensuring completeness and accuracy.

We submit the completed TAN Registration application along with the supporting documents to the relevant authorities responsible for processing TAN applications. Our team follows up with the authorities to ensure that the application is received and processed in a timely manner, addressing any queries or requirements raised by the authorities promptly.

We assist the client in maintaining proper records and documentation related to the allocated TAN for future reference and compliance purposes. Our team remains available to address any post-registration queries or concerns raised by the client, providing continuous support and assistance as needed.

Our team of experienced professionals possesses in-depth knowledge and expertise in TAN Registration processes and procedures. With a successful track record of assisting clients across various industries, we have the experience to handle complex TAN Registration requirements with ease.

VP TaxPro ensures a streamlined and hassle-free TAN Registration process, guiding clients through each step with efficiency and professionalism. We prioritize timely completion of TAN Registration applications, minimizing delays and ensuring compliance with regulatory deadlines.

VP TaxPro strictly adheres to all regulatory requirements and guidelines governing TAN Registration, ensuring full compliance and avoidance of penalties. Our meticulous approach ensures the accuracy and precision of TAN Registration applications, minimizing the risk of errors or discrepancies.

We understand that every client has unique TAN Registration needs. VP TaxPro provides personalized solutions tailored to meet the specific requirements and preferences of each client. Our team offers dedicated support and guidance throughout the TAN Registration process, addressing client queries and concerns promptly and effectively.

VP TaxPro maintains transparent communication channels with clients, keeping them informed and updated on the progress of their TAN Registration applications. Clients can reach out to us at any time for assistance or clarification regarding their TAN Registration requirements, ensuring peace of mind and confidence in our services.